IMPORTANT: For Thailand Travel Restrictions in 2023, please click the link below:

(Updated May 5, 2022)

Required Documents for Travel to Thailand

Please have the following documents ready.

- Passport

- Visa (if required)

- Buy Thailand Travel Insurance

- Flight Itinerary

- Hotel booking confirmation

- Vaccination record (if vaccinated)

- COVID-19 test result (if unvaccinated)

Incorrect documents will delay the entry screening to Thailand.

[button style=’red’ url=’https://www.siam-legal.com/axa-insurance’ target=’_blank’ icon=’icon-entypo-basket’]Buy Your Insurance Now[/button][/infobox]

Travel Insurance to Enter Thailand

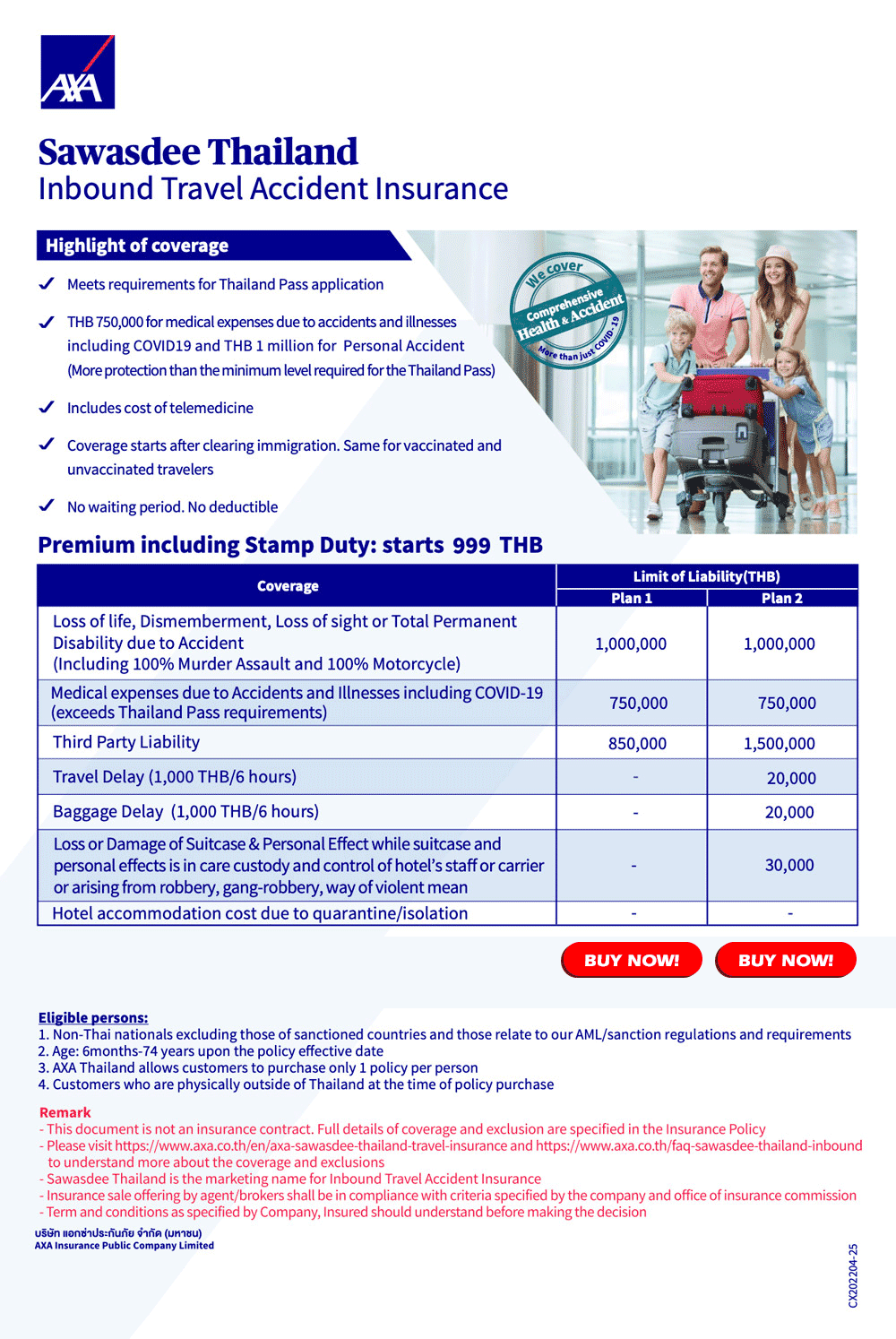

With Thailand very slowly reopening to visitors, one of the latest requirements for visitors is the mandatory COVID-19 insurance plan for foreigners that covers the traveler for a minimum of $10,000 (the Thai policies generally cover 350 thousand Thai baht). In addition to all the requirements, the traveler needs to obtain a Thailand Pass and a valid visa. This health insurance is another level of security to make sure that the traveler can cover all costs in case they are diagnosed with or die from COVID-19 during their stay in the kingdom.

Thai immigration officials are notoriously fastidious when it comes to paperwork, and will only accept policies from certain providers. Luckily, a consortium of insurance providers in Thailand offers COVID-19 insurance for foreigners planning to visit Thailand which will be accepted by immigration, and these policies can be purchased easily online. Although this could be seen as another opportunity to make some easy profits for the insurers, the policies are quite reasonably priced, depending on a few factors; let’s take a closer look.

Why is COVID-19 Insurance Required?

Whilst it may seem like just yet another hassle for beleaguered foreigners wanting to enter the country, there is good reason for the government to implement this requirement. One of the main reasons is that almost all standard health and travel insurance policies will not cover the insured against pandemics, hence will not cover you for anything to do with Covid-19. And with the costs of hospital treatment and possible repatriation, especially when considering the additional quarantine requirements to do with COVID-19, the Thai government is concerned about being lumped with a huge number of unpaid hospital bills from foreigners who come down with COVID-19.

The public health ministry of Thailand has quoted a figure for unpaid hospital bills of 448 million Baht ($14.9M) for the year up to September 2019, a huge sum. And with the threat of the coronavirus, they are concerned about this and don’t want to be stuck with another huge bill right when the economy is struggling because of the effects that the virus has had on tourism and exports. In essence, the requirement to hold one of these policies is an additional layer of security for the Thai government who is already dealing with a hammered economy as a result of the outbreak and subsequent decimation of the tourism industry which provided around a fifth of the country’s GDP.

Buy Now COVID Insurance for Travel to Thailand. CLICK HERE

What is the COVID-19 Coverage?

The COVID-19 insurance policy will cover the costs of isolation, quarantine, testing, and treatment, and the possible costs of repatriating your body in the unfortunate circumstance of you succumbing to the virus whilst in Thailand. It will also cover the cost of any medications prescribed to you as a result of being infected with the virus. The more comprehensive policies will also cover you for any losses incurred as a result of you catching COVID-19 such as lost travel bookings and trip cancellation or curtailment, be sure to check the small print of any policy before purchasing and, as always with insurance, don’t just opt for the cheapest policy.

Ultimately, most of these specialized insurance policies will comprise of three key components:

- Medical coverage. As mentioned this is a comprehensive package with a cap of a minimum of $10,000, covering all treatment costs associated with being infected with the COVID-19.

- Life insurance coverage. In an unfortunate circumstance of the insured dying from their confirmed COVID-19 infection, this covers them for a total of $10,000 which will be paid to the beneficiary stated in the policy.

- Any additional, unforeseen out-of-pocket expenses that arise as a result of you being infected with the virus. This could include lost travel bookings, flights, or any other expenses that arise from travel disruption or curtailment because of you becoming infected with the virus.

You must ensure that you retain the certificate of insurance as this will need to be shown to prove that you have the coverage, without it, you will not be granted entry into the country. Also, it should be noted that this policy will be in addition to any general health insurance policy that you may require to obtain your visa or retirement extensions.

COVID-19 Travel Insurance for Thailand

Unlike the mandatory health insurance for retirees, the COVID-19 insurance may be provided by an international insurance provider or by Thailand-based insurance providers. One of the COVID-19 insurance providers is AXA Thailand. They provide Inbound Travel Insurance for those who wish to secure Travel Insurance that covers COVID-19 as required for inbound travelers.

How To Purchase COVID-19 Travel Insurance?

This insurance is required to be allowed into the country so you will be purchasing this before you travel. The easiest way to buy your policy is online from one of the above providers who will then provide you with the all-important certificate of coverage to present to the authorities when you arrive (and you will also need to present it to the airline before they will allow you onboard). It’s quick and easy to do online, and you can choose your length of policy from 30 days to one year. Be sure that the policy covers the entire period that you are planning to stay in Thailand or you may be refused entry.

You may purchase COVID-19 travel insurance within a few minutes. Check the link below:

Fast and Easy. Buy COVID Travel Insurance for Thailand.

CLICK HERE

COVID Insurance Thailand Cost: Is It Expensive?

In a word, no, but it depends on a few factors. Although this is yet another burden and expense for foreign citizens trying to enter Thailand, it’s quite affordable. You can expect premiums to start from as little as 999 Thai baht for a policy. For the tourist visa or the non-immigrant visa application, the 90-day insurance coverage will cost 2,500 baht to 14,000 baht. As with all insurance policies, the premium will be determined by your circumstances, in this case, one of the most important factors is whether the country you are flying from is considered to be high or low risk for the virus.

Get your COVID-19 travel insurance for Thailand within few minutes.

Thailand COVID Insurance Requirement

The Thai Government has made it mandatory that foreign citizens entering Thailand have insurance coverage in case of medical needs during their stay. The insurance coverage becomes effective immediately upon your arrival in Thailand. Several foreigners have been reported to test positive for COVID-19 during their stay at the ASQ Hotel in Thailand. The COVID-19 Insurance Thailand for Foreigners completely covers their medical costs up to 350 thousand THB. You can purchase the insurance online in minutes using the Buy Now feature below. You will immediately receive the policy by email.

Summary

The cost of treatment for COVID 19 in hospitals in Thailand ranges from 700 USD to 1,000 USD per day, depending on the hospital. There may also be additional costs of staying in the intensive care unit (ICU). For foreigners who are positive for COVID-19, the cost of treatment and other medical expenses will be covered by the travel health insurance package. It is important to make sure that your insurance for Thailand covers the whole duration of your stay. Therefore, it is essential to purchase the best and reliable COVID 19 travel insurance for foreigners entering Thailand.

164 Responses

Hi,

Me and Husband will be travelling to Thailand from 5th to 13th November. My husband and me have already paid for insurance with airlines. Do we need to buy additional insurance?

Dear Supriya,

The travel insurance you bought from the airline will be enough.

Thank you.

Hi i’m visiting thailand for 8 days, but insurance package from AXA Thailand only provide 7 days or 15 days protection. is it ok if I only purchae the 7 days insurance since the price is doubled if I purchased the 15 days one.

thanks

Hi Michella,

Yes that’s okay, but your eight day will not be covered.

For more information about travel to Thailand, please check this link:

https://www.siam-legal.com/legal-guide/how-to-enter-thailand-2022-guide.pdf

I want Travel Pass Insurence for One Day , will be visiting bankok as Lay over time is about 18 hrs. Suggest best deal

Hi Suresh,

You can get and check AXA, one of the most recommended https://direct.axa.co.th/TA-Inbound/CoverageOptionPlan?utm_source=Agent_Partner&utm_medium=Direct_SiamLegal&utm_campaign=Sawasdee_SiamLegal

For more information about travel to Thailand, please check this link:

https://www.siam-legal.com/legal-guide/how-to-enter-thailand-2022-guide.pdf

Hello

I am flying to Oman from Japan through Bangkok and will be at Suvarnabhumi airport for 5 hours. I took three vaccination shots. Do I still need to get the travel insurance and PCR test?

Hi Shady,

If you are fully vaccinated, just present your vaccination certificate and passport as requirements.

For more information about travel to Thailand, please check this link:

https://www.siam-legal.com/legal-guide/how-to-enter-thailand-2022-guide.pdf

I am flying to Oman from Japan (Kansai airport) through Bangkok and will be at Suvarnabhumi airport for 5 hours (transit). I had three vaccination shots. Do I still need to get the travel insurance and PCR test?

Hi Shady,

Travel insurance is not compulsory but still highly recommended.

For more information about travel to Thailand, please check this link:

https://www.siam-legal.com/legal-guide/how-to-enter-thailand-2022-guide.pdf

can you help me explain what are the requirements for entering Thailand?

because I have plans to go to Thailand at the end of this month

I’ve been vaccinated 3 times, I’ve booked a hotel

Is it mandatory to buy travel insurance?

Hi Mita,

Insurance is not compulsory but still recommended.

For more information about travel to Thailand, please check this link:

https://www.siam-legal.com/legal-guide/how-to-enter-thailand-2022-guide.pdf

In terms of the dates to be indicated, do we only put the date range of our travel (i.e. Sept 5 to 11)? And if yes, would the insurance still covers us in case of hospitalization in Thailand starting Sept 11 onwards?

Hi TA,

You can put your coverage atleast more than the days of your travel, so just incase anything happen afterwards you are still covered.

For more information about travel to Thailand, please check this link:

https://www.siam-legal.com/legal-guide/how-to-enter-thailand-2022-guide.pdf

hello, I’m planning to take my family on vacation to Thailand next month..

my wife and I have been vaccinated 3 times, but my son, who is 3 years 5 months old, has not been vaccinated..

Can my child enter Thailand, or do I still need to do a PCR test for my child?

Hi Mita,

That would be fine, your children can enter without test if the parents are fully vaccinated.

For more information about travel to Thailand, please check this link:

https://www.siam-legal.com/legal-guide/how-to-enter-thailand-2022-guide.pdf

Hi! We are travelling to Thailand in November this year from Holland with a stop over in Saudi Arabia. We have an international health travel insurance. Do we still need to get a Thailand Pass to enter Thailand? Hope to hear from you soon. Best, Valery

Hi Valery,

Insurance is not compulsory but still highly recommended.

For more information about travel to Thailand, please check this link:

https://www.siam-legal.com/legal-guide/how-to-enter-thailand-2022-guide.pdf

I am flying to Sydney from London through Bangkok and will be at Bangkok airport for only 2 hours. I am 75 and am as vaccinated as it is possible to be 3rd booster shot was on 14th June prior to leaving Australia. I have never had Covid but take all precautions -masks, hygiene, social distance and full vaccination. Do I still need to get the travel insurance to get this Thailand Pass. (If it is that dangerous I will cancel the flight and rearrange my stopovers to avoid Thailand!)

Hi Sandra,

Insurance is not compulsory but highly recommended.

For more information about travel to Thailand, please check this link:

https://www.siam-legal.com/legal-guide/how-to-enter-thailand-2022-guide.pdf

hello!

just transiting thru BKK but thinking of doing a layover tour. Still need insurance? Thanks.

Hi Yen,

It’s not mandatory but still highly recommended.

For more information about travel to Thailand, please check this link:

https://www.siam-legal.com/legal-guide/how-to-enter-thailand-2022-guide.pdf

Hi

I am a resident of Australia and travelling with my family of five via Thai Airways and making international transit through Bangkok. Is it mandatory to buy travel insurance, even though our transit stay is not more than 4 hours.

Appreciate your quick response.

Hi Haroon,

It’s not compulsory, but still highly recommended.

Thank you

If I am already in Thailand and need a Covid-19 Insurance with immediate effect on the date of purchase, what would I do, where would I buy?

Hi Dungee,

You can check AXA here’s the link https://direct.axa.co.th/TA-Inbound/CoverageOptionPlan?utm_source=Agent_Partner&utm_medium=Direct_SiamLegal&utm_campaign=Sawasdee_SiamLegal

For more information about travel to Thailand, please check this link:

https://www.siam-legal.com/legal-guide/how-to-enter-thailand-2022-guide.pdf

HI

I have a question iam traveling from Brisbane to Bankok and from Bankok Back to Brisbane is it necessary and when I buy a insurance can that be everything online and how long would it take time.

Hi Carlos,

Insurance is not compulsory but still highly recommended. You can check this https://direct.axa.co.th/TA-Inbound/Index?utm_source=Agent_Partner&utm_medium=Direct_SiamLegal&utm_campaign=Sawasdee_SiamLegal

For more information about travel to Thailand, please check this link:

https://www.siam-legal.com/legal-guide/how-to-enter-thailand-2022-guide.pdf

To be clear, a U.S. citizen will only need:

1. Valid passport

2. Vaccination records for COVID

3. Travel itinerary in Thailand with hotel confirmations

…to enter Thailand for a 3-week vacation, beginning in late October 2022? Thanks for your assistance.

Hi Mark,

Yes,you’re right. you can also include insurance if you want for safety, it’s not mandatory but highly recommended in any cases happen.

Thank you

are singapore travel to thailand need covid insurance ?

Hi Tanhun,

Insurance is not compulsory but highly suggested.

Thank you

Hi

im travelling to Phuket from Malaysia on Aug 2

Can you advise me what do i need?

do i need the travalling insurance and the Thai pass?

Hi Sunantha,

Thailand Pass has been waived and Insurance is not compulsory but highly recommended.

Thank you

Hi if I stay in Thai airport for 4 hours 30 minutes transit .. I need travels insurance? I’m Bangladeshi and my destination South Korea

Hi Nizam,

Insurance is not compulsory but still hight suggested.

For more information about travel to Thailand, please check this link:

https://www.siam-legal.com/legal-guide/how-to-enter-thailand-2022-guide.pdf

Hi.

I will be travelling from the UK to Philippines transiting via Thailand. Do I still need PCR and Travel insurance?

Hi Shaula,

It is not mandated but we still highly recommended.

Thank you

Hi.

Is Thai pass still a requirement afterwards July 1st?

Hi Reena,

It’s no longer required.

Thank you

I will travel to Melbourne AUS through Bangkok (2 hours transiting) on 2nd July 2022. Do I need to buy the insurance? Thanks.

Hi Ghasan,

It’s an optional.

Thank you

Update! Starting from 1 July 2022, insurance with minimum 10,000 USD coverage will NO LONGER required?

Hi Jimmy,

Yes, you’re right. But we still highly recommended, better for your security. Thus, it’s up on you, it will be optional.

Thank you

I am flying from Germany and transit in BKK with 2 kids (8 and 12 Years Old) 4 Hours Layover on 02.July.2022. Do I still need to purchase Insurance?

Hi TT,

Insurance is optional starting on July 1st.

Thank you

Is entering to Thailand the Covid travel insurance still requirement after July 1?

Hi Joan,

No, it’s optional starting July 1.

Thank you

Good day,

Please advise how accurate the Thai Pass Medical insurance cover must be. I have a quote for £8m (which with todays exchange rate is cover of USD 9 841,960.00) but this is not quite USD10m. I do not want to purchase the insurance cover and it is rejected by the Thai Travel Pass authorities and approval to travel is not given. (Traveller unfortunately is older than 74 yrs so cannot use the AXA insurance recommended).

Thank you for advice please.

Hi Ginny,

You can still check AXA what travel plan is better on your case.

Thank you

Hi there, Why do we need to buy this for layovers? The terms of the insurance clearly state that coverage only starts after clearing immigration, which does not apply to passengers who are not going through immigration.

Hi Sombo,

Yes insurance still required for layover.

Thank you

Is AXA your only insurance provider for travel insurance? I was trying to buy for my 78-year old mother but the coverage covers only those born as early as 1947. What about those born earlier than 1947?

Hi Jinkee,

AXA is one of the best recommended provider. You can check your case with them, so they can give you better offer plan.

Thank you

On a flight between Vienna and Sydney Australia,I will be transiting via Bangkok airport. Transit time is 2hrs arriving and departing on June 28/22. Do I still need travel insurance.

Hi Marisa,

Yes,

Thank you

Is Thailand dropping the Covid travel insurance requirement starting July 1? Would that apply to transit passengers too?

Hi Meera,

Effective on July 1, it will be optional.

Thank you

Hi, I am just transiting in Bangkok for 3 hours for my next connecting flight, do I need to purchase covid-19 insurance?

Hi Rubiah,

Yes.

Thank you

Hi

I am a Singaporean citizen and fully vaccinated against COVID-19

I will be using Bangkok airport as a transit only .

Do I need an insurance as I will remain in transit area only before I will take a next flight?

Hi Tayyab,

Yes, if you will enter for the month of June. If on July, it will be optional.

Thank you

Hello,

Thx for your answer, but i read everywhere that traveller need 10 000 $ insurance coverage, not 100 000 $.

Excuse me for my insistence, but it’s really not clear and all insurances offer coverage of $10,000 for Thailand.

So is it 10 000 $ or 100 000 $ ?

Hi Mathieu,

Yes it’s only USD 10,000

Thank you

Hello,I am Theingi from Myanmar.

I would like to know that is I will travel from Myanmar to Phuket and still 2 months.So do I need to buy insurance for 2 months or 3 months??

Hi Wint,

Your insurance should cover the length of your stay, but it still depending on you if you plan to add extension.

Thank you

Hi, i asked visa and they ask 100 000 $ coverage for a non-O Visa. This is normal ?

Hi Mathieu,

Yes, that is the minimum requirements for all foreign travelers.

Thank you

I have a O visa, and when I was at the Thai imagration office in Summit prakan they told me I can go in and out of Thailand without having covid insurance. Is this true? I do not want to get stuck at the airport. If it is true then how do I fill out the Thai pass

Hi Richard,

For all foreign traveler, they are require to get travel insurance with covid medical coverage of USD 10,000

Thank you

hi,

can foreigners buy this insurance?

Thank you.

Hi Peggy,

Yes, go on this site https://direct.axa.co.th/TA-Inbound/CoverageOptionPlan?utm_source=Agent_Partner&utm_medium=Direct_SiamLegal&utm_campaign=Sawasdee_SiamLegal

Thank you

Hello,

does Bangkok accept international insurance that i purchase from traveloka? in the term (detail of product) i dont see about covid cover.

thanks

Hi Junaidi,

That’s okay , but it should meet the requirements for covid medical coverage of USD 10,000.

Thank you

Hi. I am going to Thailand for a two-year Masters program. Do I need to buy the USD 10000 worth insurance from insurance agents in my home country or from a Thai service provider? Please help me.

Hi RA,

One of our most recommended is AXA, here’s the link https://direct.axa.co.th/TA-Inbound/CoverageOptionPlan?utm_source=Agent_Partner&utm_medium=Direct_SiamLegal&utm_campaign=Sawasdee_SiamLegal

However, you can still get in any provider of your choice that would meet the requirements for covid medical coverage of USD 10,000.

Thank you

Hello

Can you tell me If I have Certificate of insurance Coverage with Respect to Overseas Travel Insurance Can we use it ,instead . Do I need to buy for Thai insurance ?

Thanks

Hi Ag,

Your insurance should meet the requirements for covid medical coverage minimum of USD 10,000.

Thank you

I am an expat living in Thailand for many years, but will travel outside of Thailand for 2 weeks next month. How do I buy Covid insurance that will allow me to reenter the country? These insurance say you cannot buy them if you live in Thailand.

Hi Bob,

Click this https://direct.axa.co.th/TA-Inbound/CoverageOptionPlan?utm_source=Agent_Partner&utm_medium=Direct_SiamLegal&utm_campaign=Sawasdee_SiamLegal.

Thank you

I am having trouble getting insurance because aged 77 years need help

Hi Leonard,

You can contact the insurance provider, open this page https://direct.axa.co.th/TA-Inbound/CoverageOptionPlan?utm_source=Agent_Partner&utm_medium=Direct_SiamLegal&utm_campaign=Sawasdee_SiamLegal

Thank you

Hi, is it still necessary to have an insurance that cover min. of 10,000 USD for COVID or no more covid insurance necessary? Thanks

Hi Laura,

Covid insurance was still required.

Thank you

Hi,

We have our own BUPA insurance coverage and it covers most of those required.

Can we use that instead?

Hi Liz,

Yes, that would be fine as long there’s a covid insurance coverage minimum of USD 10,000

Thank you

do i need health insurance for transiting through Thailand?

Hi Tejraj,

Yes still needed.

Thank you

Hi

Does Baby 10 month old need to buy the travel covid 19 insurance to enter thailand?

Hi Kristabella,

Yes , you can avail here https://direct.axa.co.th/TA-Inbound/CoverageOptionPlan?utm_source=Agent_Partner&utm_medium=Direct_SiamLegal&utm_campaign=Sawasdee_SiamLegal

They cover age of 6 months and above.

Thank you

I’m flying to Thailand from UK mid July and returning to UK mid August from Thailand but I want to visit Vietnam for a break in the interim.

Will my Thailand covid medical insurance cover me for full month I’m in Thailand or will I have to renew it when I re-enter Thailand from Vietnam.

Hi Guy,

AXA can be use for single entry only.

Thank you

Hi What is the excess you have to pay on these insurance policies ?

Hi Delboy,

Excess in what policy please?

Thank you

How much insurance coverage should a student going on a student visa need for the Thai Pass? Thanks

Hi J,

All foreign travelers are required to get a minimum coverage of USD 10,000 for their covid insurance.

Thank you

Hi Rex,

Do I need insurance for just flight exchange?? I will be staying in Bangkok Airport for just 2 and half hours. Thanks

Hi Ahsan,

For layover, yes still recommended.

Thank you

Hello…I have a extremely good insurance that covers covid 19 worldwide and up to 15 million in medical expenses for my entire family…do I have to buy additional insurance from a Thai company… I find that very odd and seems like another money scam to help the Thai insurance companies…:)

Hi Sverre,

You can use it , if it has coverage for covid medical treatment.

Thank you

I’m travelling from Melbourne to London via Thailand. I will be waiting 8 hours in the airport between my flights. Do I still need insurance?

Hi Tom,

Yes.

Thank you

Hi there,

My credit card has complimentary travel insurance with no cap on medical expenses. Does it satisfy the entry requirement or do we still need COVID-specific travel insurance?

Hi Randall,

It should have covid insurance with a minimum coverage of USD 10,000.

Thank you

Hi Rex,

My Wife and I are both aged 75. We have previously bought Axa Thailand Covid Insurance for previous 60 day Tourist Visas but cannot do so now because of our ages. The drop down length of stay on the covid 19 tgia.org website only allows for a 30 day Period of Coverage. What other reputable Insurance Companies would cover over 75s with Tourist Visas please?

Hi Ross,

Please check this site https://direct.axa.co.th/TA-Inbound/CoverageOptionPlan?utm_source=Agent_Partner&utm_medium=Direct_SiamLegal&utm_campaign=Sawasdee_SiamLegal

Thank you.

Hi there

Do we need a covid insurance even if we are transiting passengers (5 hrs)? Travelling to India from Melbourne in July and returning via the same route on Thai Airways (only transit in BKK)

Also I understand there is a free covid insurance for Australian passport holders travelling on Thai Airways, does that apply to NZ passport holders too?

Thanks in Advance

Hi Sam ,

Yes, with a minimum coverage of USD 10,000.

Thank you

Hi there

I am travelling SYD-LHR via BKK and will be in the city for less than 24 hours on 6 june 2022. Do I still have to buy the covid19 medical insurance or is there a waiver for people transiting?

I have my own travel insurance but it does not cover the virus.

Hi Georgie,

Yes, still recommended to have covid insurance for transited flights

.

Thank you

Rex, I’m 74 and reside in Thailand with ‘O’ visa (1 year). I just travelled and had to buy travel insurance for return. I’m travelling again in June so knew the interval of my stay in Thailand. I travel frequently but irregularly. I’m confused that I need travel insurance to return to my home (where insurance is not required). How can I buy a policy in thailand that covers frequent exit/entry and living in Thailand?

Hi Frank,

Travel insurance with your covid coverage is just a single entry.

Thank you

I am a US CZ traveling to thailand June 24-27 2022. I have proof of my health insurance from America. Would that be sufficient or do I still need to buy additional health insurance policy to enter Thailand? I have already been approved for the Thailand pass by providing health insurance from America. Thank you!

Hi American tourist,

It should have covid medical coverage minimum of USD 10,000.

Thank you

Hi, I plan to travel to Thailand from India, stay for 15 days, go to Cambodia and come back to Thailand for a week before flying back to India. As an Indian citizen, I am eligible for a 15 day visa on arrival, and since I will be entering the country 2 times, I will be applying for the visa on arrival and Thai pass 2 times.

The entire duration of my travel will be 28 days. Would it work if I purchased a 30 day covid insurance and use it for both the times I apply for the Thai pass or would I be required to purchase 2 policies of 15 days each before each entry to Thailand.

Hi Kin,

Yes, separate every entry.

Thank you

Do I need Thailand Insurance for COVID even if I am in transit at Bangkok airport?

Hi Pradip,

Yes.

Thank you

My Birthday is 07/11/1940

I frequently travel to Thailand 2 times a year

this year I will travel to Bangkok late June for 4 weeks and than again mid November this year again for 4 weeks

I have the Australian Government COVID pass

and I have my personal Goverment Antigen Rapit Test { Nasal Swob

Please send me costing for your Travel Insurance

Peter Schmidt

Hi Peter,

For foreign traveler, we highly recommended AXA for travel insurance with covid medical coverage https://direct.axa.co.th/TA-Inbound/CoverageOptionPlan?utm_source=Agent_Partner&utm_medium=Direct_SiamLegal&utm_campaign=Sawasdee_SiamLegal

Thank you

Hi There

My mum is going to transit from thailand. She is coming from melboune and going back to Turkey however in transit she will be in Bankhkok for 3 hours. Does she need a covid insurance just for transit

Hi Melissa,

Yes,

Thank you

Do you accept family plan for travel insurance?

Hi William,

Yes, make sure all names of members were included in the certificate.

Thank you

Hello! Would you please advise if i still need an insurance, even just transit for few hours in Thailand, not entering the nation.

Hi Ya Hui,

Yes.

Thank you

Do you accept a family insurance plan?

Hi WillT,

Yes, Check here https://direct.axa.co.th/TA-Inbound/CoverageOptionPlan?utm_source=Agent_Partner&utm_medium=Direct_SiamLegal&utm_campaign=Sawasdee_SiamLegal

Thank you

Do children under 18 also need travel insurance? Thanks!

Dear Jessica,

Foreigners whether child or adult are required to have COVID insurance in order to get approval of Thailand Pass.

Thank you.

My birth date is 1 August 1940 & my wife’s is 24 June 1945.

The AXA insurance site does not allow for these older birth dates. What do we do?

We depart Australia on 1 July 2022 & depart Thailand for Australia on 30 July 2022.

We will be 29 nights in Thailand.

Please advise.

Dear Donald,

You may check this page as alternative: https://covid19.tgia.org/

Thank you.

I am 75 years old,coming from Spain in may.Do you have the mandatory $20.000 insurance for me for a period of about 2 weeks?

Dear Egon,

Yes, you still need to have a COVID insurance in order to get a Thailand Pass. You may get an insurance for 75 years old or above on this page: https://covid19.tgia.org/

Thank you.

Hi. I’m from MALAYSIA. Can I use my own MALAYSIA’s insurance to apply the Thailand Pass ?

Hi JC,

Your insurance policy must have cover for Covid-19 and hospital expenses in Thailand.

Thank you.

Hi Rex, as a Turkish citizen who is Special passport holder which is allowed for 90 days without visa by Thai government; if I only wanna stay there like 30 days, should I still buy 60 days insurance or 30 is enough? And is return/out ticket from country is mandatory? Big thank you.

Dear Joe,

Good day.

If you have a return flight, you can buy an insurance valid from date of entry and date of exit from Thailand. Yes, exit flight is required to determine the validity of the insurance that you need. To buy the insurance, please visit http://www.siam-legal.com/axa-insurance

Thank you.

Hi Rex, can I use the COE COVID-19 insurance to apply for the Tourist Visa (60days)? Are they the same? Thanks!

Dear Delson,

Good Day!

Yes, you can use the same insurance. You just have to make sure that the insurance will cover the validity of your visa or your stay in Thailand.

To purchase the correct insurance please go to: http://www.siam-legal.com/axa-insurance

Thank you!

Dear Rex

I am entering on a Non immigrant B visa which is valid for 1 year.

Can I enter with 90 days insurance and renew it when I am in Thailand? Or do I have to have a 1 year insurance in order to enter Thailand?

Thanks

Zach

Dear Zach,

Good day.

If your 1 year non immigrant B visa was issued by a Thai Embassy with multi entries, you are only permitted to stay for 90 days per entry correct? You can use a 90-day COVID 19 Insurance. Please check this page to purchase the insurance:

https://www.siam-legal.com/axa-insurance

Thank you.

The AXA website isn’t working

Dear Jacky,

Good day.

I checked the links on this page, the links are working.

Thank you.

Thanks for awesome and timely responses to questions on this platform

If I want to travel to Thailand from Nigeria for an holiday. What’s the procedure. Thanks

Dear Adediran,

Thank you for your comment. Please check our Guide on How to Enter Thailand in 2021 on this page:

https://www.thaiembassy.com/travel-to-thailand/how-to-travel-to-thailand-in-2021

Have a good day.

Hello,

Is it really necessary to purchase this insurance *before* submitting the “Pre-approval” COE application? This seems risky. I am from a visa-exempt country, but if my application is rejected for some other reason, I will have wasted the money spent on the premiums.

Dear Michael,

Good day.

Yes, on the part one of the COE Application, the insurance is required. If you are going to apply for the Visa Exemption, it is very likely that it will be approved as long as your have a flight exiting Thailand within 45 days, you have an ASQ and your Insurance is valid for 60 days.

Thank you.

Hi there

Please contact me I need coe visa

Thanks

Dear Fadil,

Please check this page:

https://www.thaiembassy.com/thailand-visa/coe-thailand

It has a comprehensive instruction on how to apply for COE.

Thank you.

I have sent relevant pages to COE my Insurance Certificate, clearly sets out, that it cowers 100,000 USD For Covid -19

Just received, notification my application has been rejected, in reference to above, not sure, what to do, wont help to send Certificate again.

Kind regards

Leif

Dear Leif,

The only wait this insurance will be rejected is for the reason that your visa is under category O-retirement or category OA or OX visa.

Thank you.

Hi I’m traveling from US with my 15-year daughter to Thailand. Can you please confirm if I and my daughter can be quarantined in the same room ?

Dear Kulwant,

Good day.

Yes, parents and children can stay in one room. You may consider a Family Room. Please check this page for more information:

https://www.thaiembassy.com/asq-hotels/courtyard-by-marriott-bangkok

Thank you.

when can i come to thai;and as a vistor and a hoiladay

Dear Mick,

You may now travel to Thailand for holiday. You can apply for the 45-day Visa Exemption and COE. Please check this page for the information:

https://www.thaiembassy.com/thailand-visa/coe-thailand

Thank you.

I come on a tr visa to Thailand and want to switch to ed visa for one year. Can i get a covid insurance for 90 days, and when i switch to ed visa in thailand a insurance for 365 days?

Dear Pieter,

Yes, 60-day or 90-day COVID 19 insurance is enough for your visit to Thailand. Once you have successfully entered Thailand, if you wish to switch to ED visa, the COVID 19 insurance will not be required by the local immigration office.

Thank you.

Hello

And what if have tr visa and change to ed visa, and stay for one year then it will be expensive?

Dear Pieter,

You only need the COVID 19 insurance for the duration of your TR visa. In that case, you only need 60-day insurance policy.

Thank you.

hi

i am looking to have a health insurance for 60 days that cover covid 19 for visiting thailand

Dear Os,

Good day.

You may purchase COVID 19 Insurance and receive the certificate within minutes. Please check this page: https://u.axa.co.th/Sawasdee_Siamlegal

Thank you.

Hello. Do i need to print out all the certificates, ir just by having them on My phone (digital) is enough?

Hi Luis,

Better to prepare hard copy , it makes your transaction faster.

Thank you